SeekingAlpha: Hyundai Motor Securities publish a research and forecast on Korean smartphone component manufacturers:

The ongoing multi-camera trend will see the birth of even penta-camera phones in 2020 with up to five cameras on the back. By brand, we expect the maximum number of cameras to be installed on the back of a smartphone to be five for Samsung (the Galaxy S20), four for Apple, five for Huawei, and five for Xiaomi. For the models with these cameras, the number of camera modules will have increased by one vs. their predecessors debuted in 2019, meaning that 2020 will be characterized by the year for triple- or quadruple-cameras.

According to industry data, the percentage of smartphones with three or more cameras in total global shipments was 15% in 2019 but the number looks likely to grow to 50% by 2021. In the case of Samsung, we estimate the proportion of multi-camera modules will increase from 55% (or 870mn units) in 2019 to 69% (or 180mn units) in 2020.

We expect Korean and Chinese smartphone names to move to increase the use of penta-cameras in their smartphones in 2020.

The market for 3D sensing cameras is expected to continue growing. According to Trendforce, the 3D sensing camera market is forecast to expand to USD5.96bn with 20% of smartphones adopting 3D sensing cameras. Indeed, smartphone markers' use of ToF is steadily rising. Samsung first introduced ToF in 2019 through the Galaxy S10 5G model, and Apple is expected to start adopting ToF cameras with its new 2020 models.

The greater numbers of cameras per device mean the wider use of cameras. Currently, multi-cameras in smartphones not only include a viewing camera for taking pictures or videos but also a 3D sensing camera for space recognition. 3D sensing technology in smartphones has gained attention since Apple introduced Face ID through the iPhone X after forfeiting the home button and fingerprint recognition. Now, most smartphone brands have begun to adopt 3D sensing cameras.

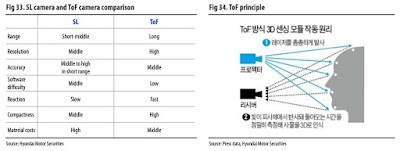

ToF is a 3D sensing camera that calculates the time of flight from the laser from a projector to the receiver. The previous structured light (SL) method is a system that receives and analyzes the surface curvature of objects using infrared rays. Requiring a processor for analysis, the method's weakness is long distance and variable factors that might happen externally. Now, ToF calculates the time of return, hence there is no need for a separate processor. It also consumes less power, responds more rapidly, and recognizes longer distances using a laser vs. the previous SL method.

As the use of ToF increases, ToF suppliers should continue to benefit in 2020. In particular, LG Innotek is slated to enjoy larger sales and profits as it supplies Apple's ToF cameras. In 2020, we believe even mid- and low-end models will start to adopt ToF cameras, as the prices are expected to decline vs. 2019 with more suppliers beginning to supply ToF cameras.

According to an industry source, the image sensor market is forecast to grow 69.8% by 2024 to form a USD20.9bn market. The autofocus (AF) function became the norm in smartphone cameras, and the advancement in actuators such as optical image stabilization (OIS) or folded zoom has also helped boost camera module ASP.

Subscribe to:

Post Comments (Atom)

0 Response to "Hyundai Securities about Smartphone Camera Market"

Post a Comment